Household hunting is significantly off enjoyable, but before you begin looking, it’s important to know what you can afford.

Just like the requirements will vary ranging from home loan issues, there isn’t a one-size fits all the signal with the quantity of income must end up being preapproved to possess home financing.

- Income: What kind of cash you draw in per month. Income will come out-of a job otherwise several jobs, leasing possessions, financial attract, royalties, money growth, plus.

- Debt: What kind of cash you only pay away per month. Obligations include credit debt, student loans, car loans, most recent mortgage loans, loans, if you don’t cash advance.

- Assets: Complete value of that which you individual. Loan providers primarily do your research on property which can be with ease confirmed and you can liquidated if needed into the purchase. Samples of this could be deals and you may examining profile, assets, advancing years money and gift finance.

- Liabilities: Complete property value your debts anybody else. Commonly, this really is mistaken for loans while the all the expense are obligations. not, liabilities likewise incorporate youngster help or alimony or any other long-term financial obligation.

Your financial takes into account all of these items to see the complete financial visualize. After that, they will regulate how much in order to mortgage an applicant predicated on those individuals situations.

When capital a different sort of home or property, your revenue, new advance payment count, along with your living expenses determine the mortgage number. Your credit report and you can credit history might be an element of the considerations because the predictors of your interest.

Self-help guide to Mortgage Recommendations

In most cases out-of thumb, loan providers choose your home loan be below twenty-eight% of your revenues. The monthly gross income is sold with your own income, incentives, and you can outside earnings. This means for folks who (or a variety of you and good co-owner) make $5,000 30 days, your personal lender is looking for financing you to leaves the newest month-to-month homeloan payment near or less than $step one,400.

You to payment often comes with the expense of Personal Home loan Insurance rates (PMI), taxes and you will home insurance. As a result industry where you’re conducting your house research may feeling your loan number.

- Could you anticipate making more money?

- Do you ever sustain significantly more debt?

- Do you realy establish over 20% to the financial otherwise smaller?

This type of circumstances can affect the new twenty-eight% signal seriously or adversely and they are referred to as side-prevent ratio to possess determining eligibility.

Knowing the Back-stop Ratio

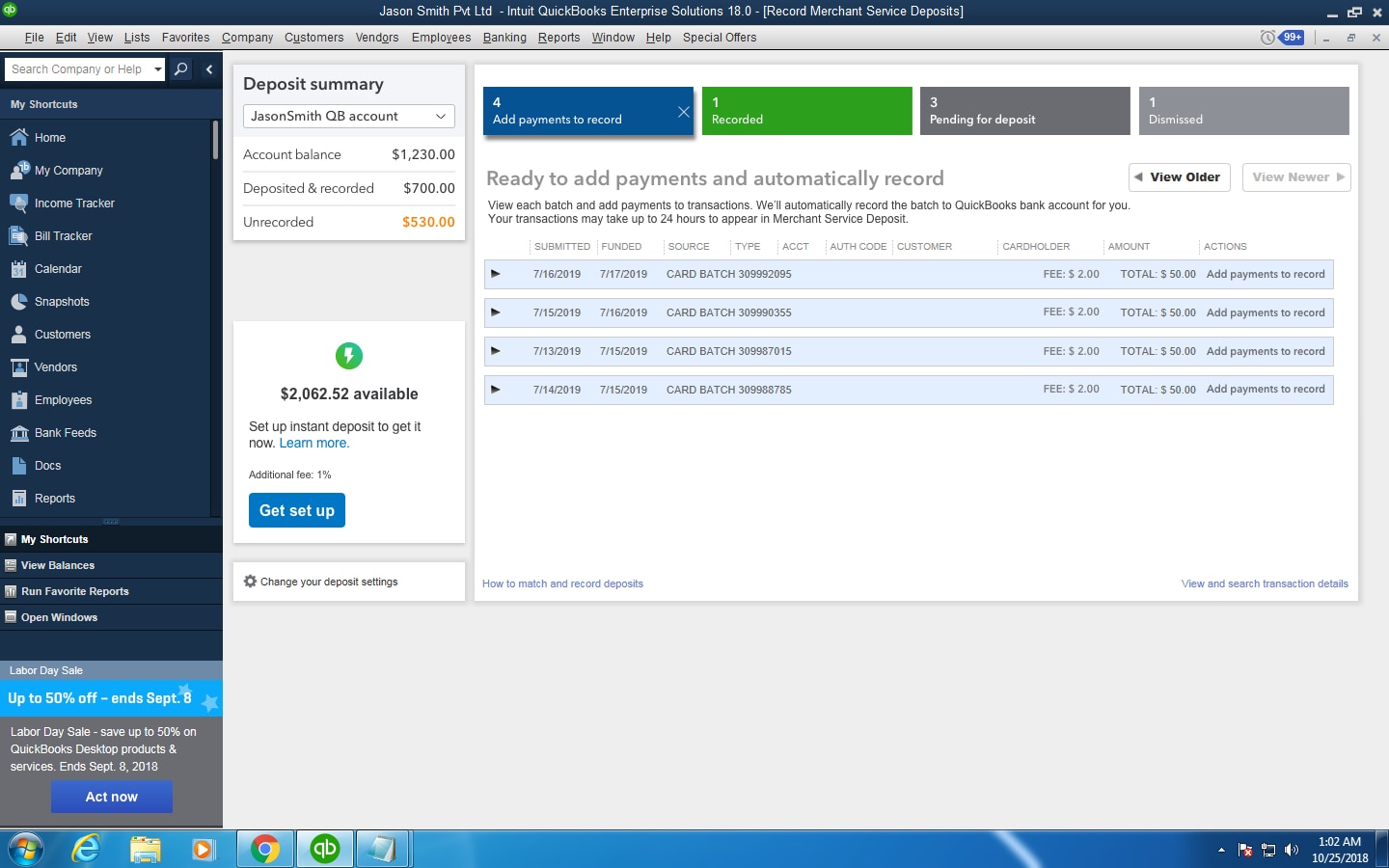

Your own bank could also be helpful your quantify the debt-to-earnings proportion (DTI). That it algorithm facilitate a lender recognize how much money it entails to pay for the debt.

Yet another guideline: the DTI should not be over 43% of earnings. So, whenever you are however and make $5,000 four weeks along with a good $300 vehicle payment, $2 hundred 30 days for the credit card costs, these costs could be set in their future construction payment regarding $step one,400 to select the back-avoid proportion, that this example, would-be 38%.

A top DTI usually reduces the entire amount borrowed wherein a borrower you certainly will meet the requirements. A lower life expectancy DTI allows a debtor to apply for a higher loan amount.

The greater your credit rating, the better the options might possibly be for mortgage loan. The reduced your rate of interest, the better your own certified financial was (once the you are able to shell out a smaller sized percentage of their payment per month so you can focus, you really can afford increased loan).

So you’re able to be eligible for a knowledgeable interest, it is necessary to possess an excellent credit history. FICO lists any credit rating at or a lot more than 720 just like the sophisticated. A beneficial good credit history falls ranging from 690 and you can 719.

Fico scores throughout the highest 600s or lowest 700s can always be made better. With some functions, you could enhance your credit history up to 100 affairs within the six weeks , that replace your choices for a reduced rate of interest.

Having the Mortgage

When your personal lender will provide you with preapproval selection, it’s sooner your choice, the new borrower, to choose your loan comfort level.

The thought of spending almost a 3rd of the revenues per month towards a home percentage can be different for several somebody. Simply because you qualify for a great $five-hundred,000 mortgage does not mean payday loans without bank account in Memphis you need to take it.

Check out the neighborhood and field where you’re seeking to move and you may a number of the almost every other need. Imagine if you reside a district today with an exciting public transportation system, and you’re packing to move to a farm. If you don’t have a vehicle today, you will likely need one out of an outlying area, so as that added expense will make you think of a smaller monthly percentage and you can, for this reason, a smaller financing.

Although not, in the event the reverse is true and you are selling a car or reducing your monthly obligations in other implies (paying figuratively speaking, for instance), you might feel like you’re in the right position to pay for the higher amount borrowed.

Once you understand your credit rating and you can month-to-month financial frame of mind at the earliest ending up in your own personal lender have a tendency to make suggestions on a better comprehension of their home loan.

clomid for men can i buy clomid no prescription can i get clomid pills order clomid without insurance can i purchase cheap clomid for sale get clomid without a prescription how can i get clomid no prescription

The thoroughness in this draft is noteworthy.

Thanks on sharing. It’s top quality.

order azithromycin 500mg online – order ciplox 500 mg pills purchase flagyl pill

buy semaglutide 14mg – periactin pills cyproheptadine 4mg cheap

motilium 10mg cost – generic sumycin 500mg order cyclobenzaprine 15mg pill

azithromycin 250mg tablet – purchase tinidazole pills bystolic 5mg without prescription